There are three main storylines pulsating through the gambling industry right now.

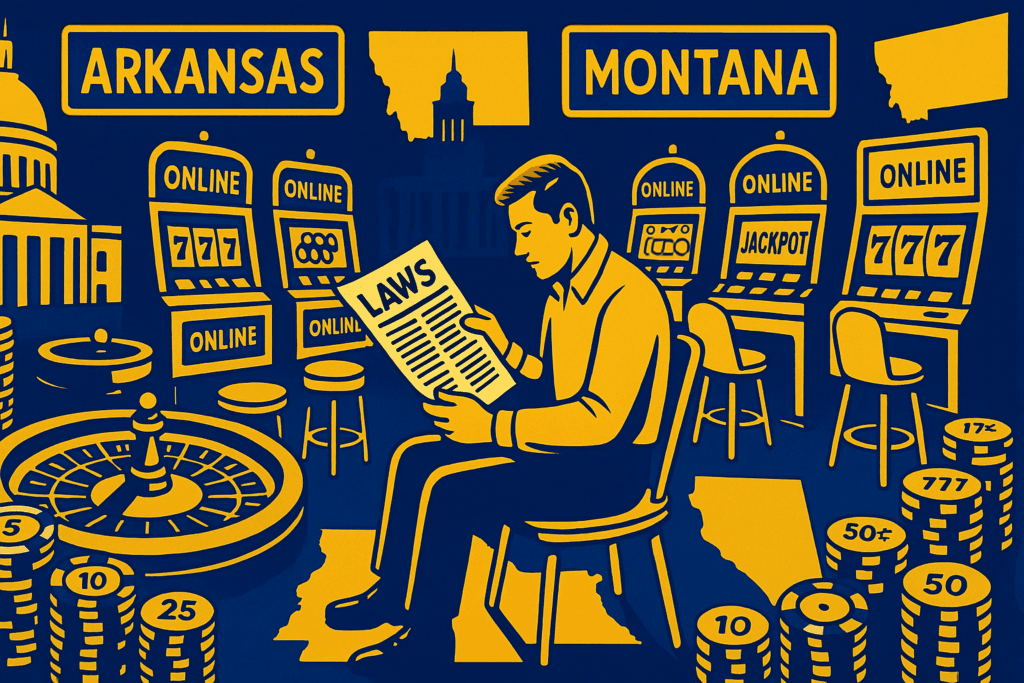

- Pressure is mounting on sweepstakes operators as more and more states start to position themselves against the dual-currency gaming model.

- The annual burst of excitement as new iGaming bills are filed is in full swing.

- More states are looking at online gambling revenue and thinking, Man, can we get some more of that flowing our way?

Storyline No. 3 is getting the least attention, but it could arguably have the largest impact.

In the past year, we have already seen Ohio double its sports betting tax rate from 10% to 20% and Illinois change its 15% tax rate to a progressive 20-40% scale. New Jersey also considered a tax hike from 15% to 30%. There are two bills in Michigan that would raise the sports betting tax 0.1% and the online casino tax by 1% for each tax bracket. Louisiana for a time considered a bill that would have rocketed its sports betting tax rate to 51%, like New York’s.

Last month, in his 2026 budget proposal, Maryland Gov. Wes Moore suggested the state double its sports betting tax rate from 15% to 30%.

And just this week, Ohio Gov. Mike DeWine proposed raising his state’s sports betting tax percentage — again — from 20% to 40%.

Lack of new regulated gaming options hurting existing operators

Lawmakers are increasingly turning to online gambling as a source for tax revenue. Do you think all those legislators in states proposing iGaming bills this legislative cycle just love to play some online slots? No. (Well, maybe.)

They, like all of us, really, have an eye for money.

And they see the mammoth revenue potential of online casinos and, thus, the mammoth tax revenue potential.

The problem is … momentum for online casino legalization is essentially at a standstill. Yes, there are some bills being considered, but you’d be hard-pressed to find an industry stakeholder who would bet their house on any of them passing.

So … what’s a lawmaker to do?

Ah, yes. Increase the taxes on the online gambling that’s already allowed.

Operators are literally asking customers to email lawmakers

Real-money operators are, uh, not thrilled.

The Sports Betting Alliance, which consists of DraftKings, FanDuel, Fanatics, and BetMGM, has pre-written forms that Michigan and Ohio residents can fill out and send to lawmakers, urging them not to raise online gambling taxes.

Here’s what the Ohio form says:

Dear [Lawmaker],

I’m concerned about the push for even higher taxes on legal sports betting across the country, that’s why I’m asking you to protect legal sports betting and keep it fair for Ohio fans like me.

I love game day and part of the reason is because of online sports betting. But the government imposing higher taxes means fewer bonuses, worse odds, and less competition — hurting the very people and legal operators who play by the rules.

Let’s stop raising taxes on hard-working Ohioans and the games we enjoy. That’s not the way we do it here in the Buckeye State.

During a Gaming Americas webinar in November, Martin Lycka, senior vice president for American regulatory affairs and responsible gaming at Entain, expressed frustration with the growing trend of lawmakers eyeing increased tax rates on established operators.

“Any other state that’s considering raising taxes, hoping that could fix all the other problems, well, I would strongly suggest that’s not necessarily the way you’re better off,” he said. “That’s the key message.”

So … could sweeps regulation actually help?

Now, here’s a thought: Might these lawmakers be less eager to inflate taxes on established operators if they could simply regulate and add taxes to a gray market industry that already exists in their state? Say, oh, perhaps the sweepstakes industry?

At this point, it’s a fair argument to say states may be more likely to regulate sweepstakes casinos than legalize online casinos. (Although it’s a fine line.) However, traditionally, real-money operators have been some of the stoutest opponents of sweepstakes gaming regulation.

Could that change as more and more states consider raising online gambling taxes?

Might real-money operators see sweepstakes regulation as a way to escape jacked-up taxes?

It’s an interesting thought, but one that — at least currently — doesn’t hold much weight, according to US gambling consultant Dustin Gouker.

“I don’t think higher tax rates will play into how regulated operators view the sweeps industry in the short term,” Gouker told Sweepsy. “I believe most of the top operators remain pretty aligned against it. Correct or not, they mostly see it as competitive to their existing business now and in the future.

“I also don’t find it terribly likely we get widespread sweepstakes regulation or taxation in the short term.”

Time will tell if real-money operators reach an inflection point — a point where the trend of increased tax rates becomes so widespread that, perhaps, stepping out of the way of sweeps regulation becomes a viable path to keeping more revenue in their pockets.

But, for now, that doesn’t seem likely. Real-money operators will try other options — such as lobbying and urging customers to contact lawmakers — to stymie the trend of increased tax rates.